Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

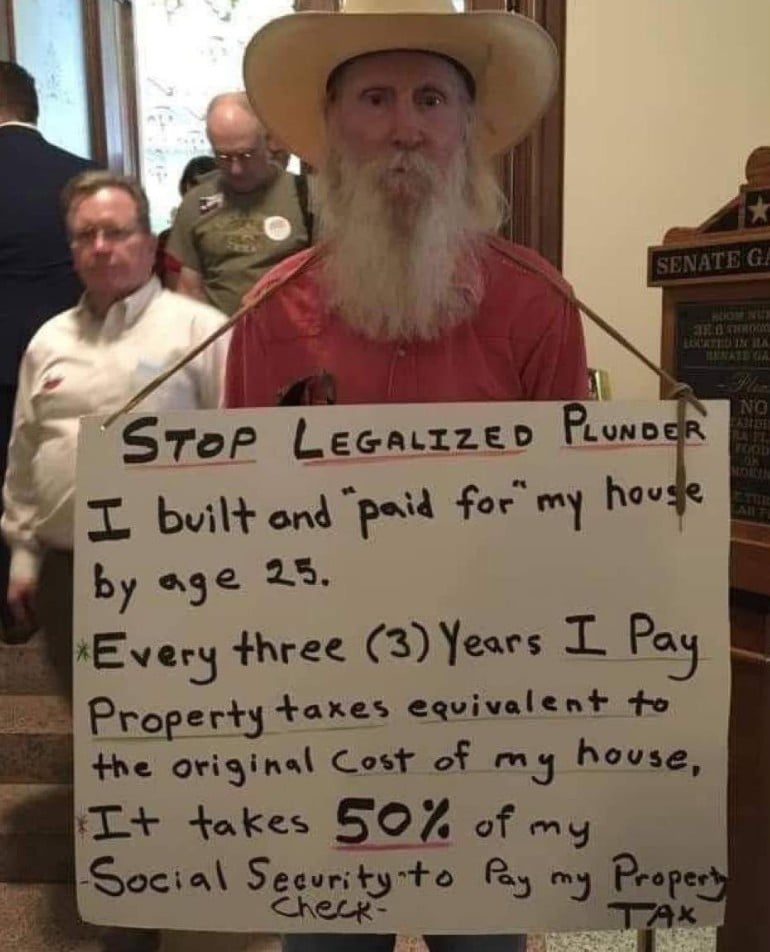

Do the American thing and chuck it in the harbor until the taxes stop

California disagrees: https://en.m.wikipedia.org/wiki/1978_California_Proposition_13

Property tax is assessed when there's a sale, and otherwise changes very slowly. It's a controversial measure.

Which induces a lot of absentee landlordism, as property is held in trust and financialized rather than being bought/sold at the retail level.

That's the thing about increasing home prices nobody talks about. It increases the "value" of your home, so you're taked more.

When my parents retired, they didn't move out to the country to get away from the city life. They did it because it saved them 40 grand a year in property taxes.

Where the fuck did they live? What was the home value and tax rate? That's insane.

I don't know his situation but I think primary residence up to certain value shouldn't be taxed at all. There's a huge difference between an old man living alone in a house he had built for his family 60 years ago and an "investor" who owns entire neighbourhoods. Unfortunately, where I live a property tax on as far as I remember 4th and all above residential properties has been proposed and people who oppose it the most are pensioners who live in the only property they own. Right wing media can just outright lie to people telling them the tax is going to be on every property and people go on vote against their own interests.

How big is his house? How much is it worth now?

How much did he pay for the land it sits on? Or did he inherit that?

Who does he think maintains road networks and all the other infrastructure he relies on?

How big is his house? How much is it worth now?

Property taxes are based on the assessed value of the land. So if you bought vacant land in the 1970s, improved it with a home, and then lived in it for the next 50 years, you'd see a piece of land that sold for several thousand dollars accrue to hundreds of thousands of dollars. If this guy is living in Texas, he's likely paying 1-2% of the assessed value of the home, which could easily be north of $2-4k/year. That's on land that was practically being given away half a century earlier.

Who does he think maintains road networks and all the other infrastructure he relies on?

The tax rate is fully disconnected from the cost of construction/maintenance. So if my house accrues from $50k to $200k over the course of ten years, I don't see 4x as much construction/maintenance of my local infrastructure. I just see my tax bill go up 4x while my potholes continue to go unfilled, my lines unburied, and my flood control underdeveloped.

And that's setting aside the habit of municipal governments to invest in "improvements" (sports stadiums, convention centers, police surveillance that's focused around corporate properties, twelve lane highways that induce demand rather than improve traffick flow) that benefit private industry over public welfare. City and state officials serving larger and larger constituencies routinely become disconnected from lay voters and increasingly complicit in graft and other kickbacks, as elections revolve more around partisan affiliation than any actual domestic management agenda.

There is a very real and meaningful disconnect between what politicians do at the municipal/state level and what residents actually demand at the retail level. If this guy was perched in a penthouse overlooking Cowboy's stadium, you could reasonably tell him to fuck off. But I guarantee he's not.

allowed to take surplus tax,

He's likely towing the Libertarian party line. We'd be fine without these taxes and all that government waste.

When you start asking about public services, they start, slowly, carefully re-inventing taxes while downplaying corporate greed while putting themselves in a decision-making role where they get to decide what is right for everyone else.

I'm sure he can hardly afford to live in his ancestral home. That SS he paid into all those years doesn't hit the same as a paycheck and might stop altogether soon. If you don't squirrel away your own retirement, you have to make concessions.

Property tax rates are based on how much your city/county needs to operate. Property values change, but so do mill rates. Most cities aren't allowed to take surplus tax, so they tweak the mill rate when property values fluctuate.