Sick and tired of fucking welfare queens (big oil) stealing money from actual hard-working Americans (renewables).

Climate - truthful information about climate, related activism and politics.

Discussion of climate, how it is changing, activism around that, the politics, and the energy systems change we need in order to stabilize things.

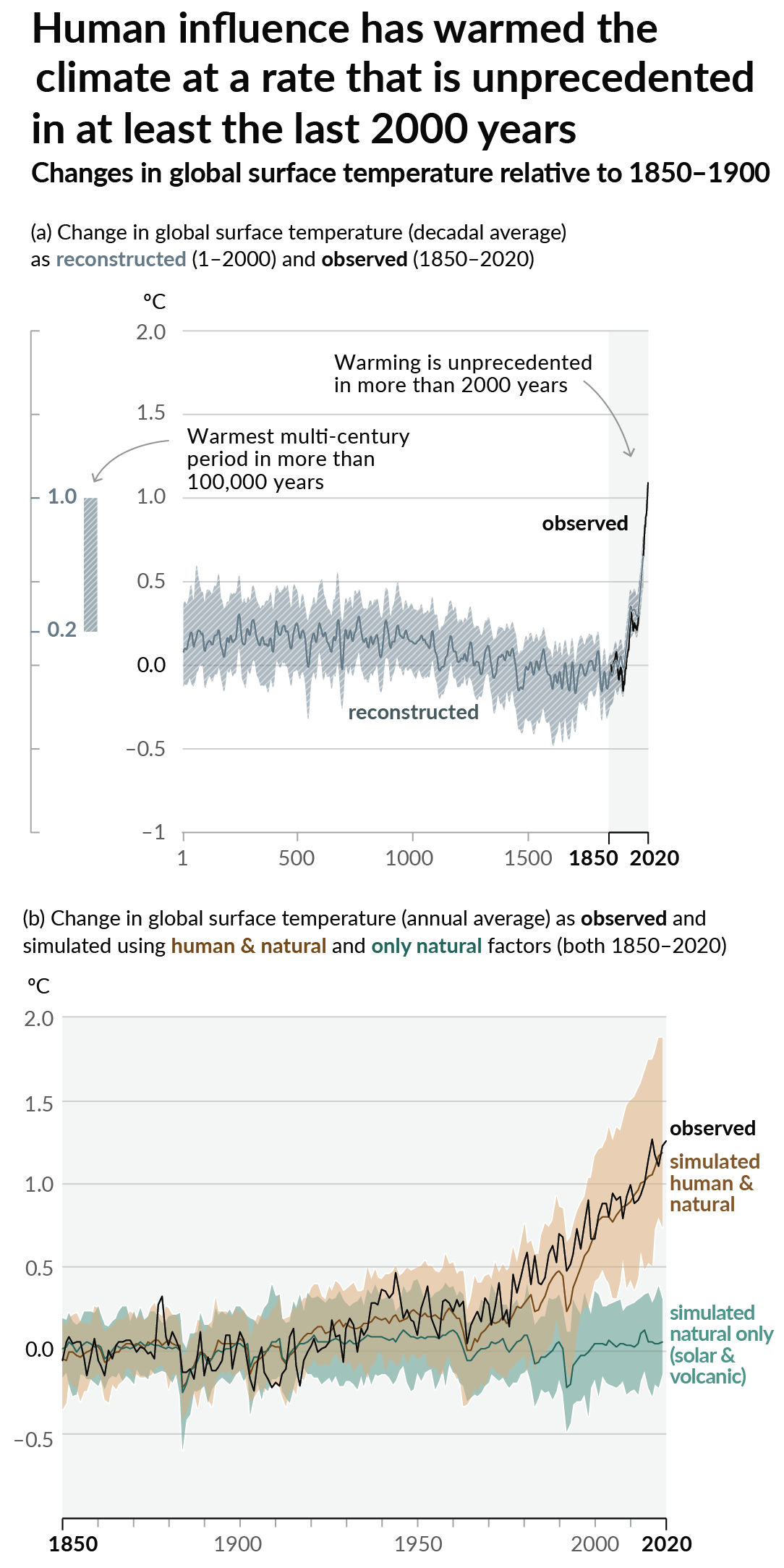

As a starting point, the burning of fossil fuels, and to a lesser extent deforestation and release of methane are responsible for the warming in recent decades:

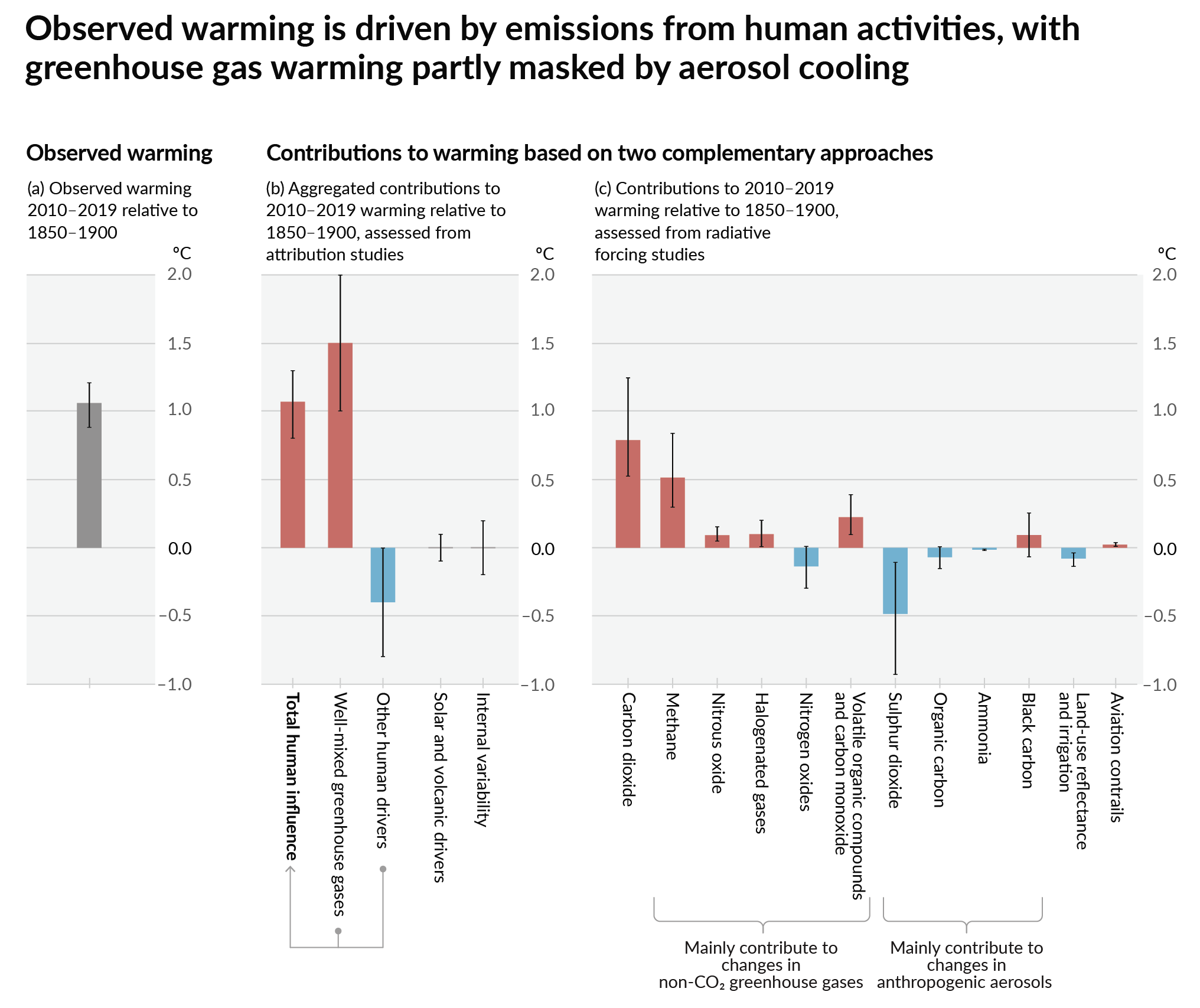

How much each change to the atmosphere has warmed the world:

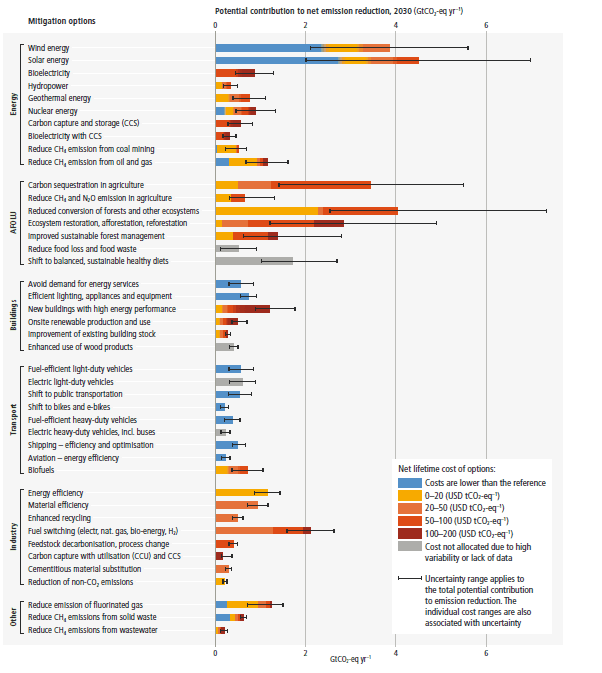

Recommended actions to cut greenhouse gas emissions in the near future:

Anti-science, inactivism, and unsupported conspiracy theories are not ok here.

Corporate tax deductions for intangible drilling costs have been available since 1913, making it “the oldest and the largest fossil fuel subsidy on the books,” according to a recent report on the Lankford bill. In current law, all the costs of drilling oil and gas wells can be deducted in the year they are incurred, rather than over the lifetime of the well.

The CAMT weakens that deduction by requiring drillers to pay some tax, but the Lankford bill would effectively apply the deduction to the CAMT directly, taking many drillers below the threshold of qualifying for minimum taxes. “We need to be able to get some relief to them so they’re not constantly worried about it,” Lankford said in a CNBC appearance in January.

At least they accept that tax breaks are subsidies. That's how tax breaks should always be presented.

The Senate Finance Committee aims to change that. Section 70523, buried on page 343 of the 549-page draft text, makes a tweak to the CAMT by directing the Internal Revenue Service to take into account “intangible drilling and development costs.”

Is this what Peak Oil looks like?

Is this what Peak Oil looks like?

No, just corruption. In case of peak oil, they would support alternatives as well.

The CAMT weakens that deduction by requiring drillers to pay some tax, but the Lankford bill would effectively apply the deduction to the CAMT directly, taking many drillers below the threshold of qualifying for minimum taxes. “We need to be able to get some relief to them so they’re not constantly worried about it,” Lankford said in a CNBC appearance in January.

The audacity...